Index:

Chapter 9

Chapter 10

Chapter 11

Chapter 12

Chapter 13

Chapter 14

Chapter 15

Chapter 16

Chapter 9

Chapter 9 -Essential Questions:

- Why are adjustments journalized?

- What do the ending balances of permanent accounts for one fiscal period represent at the beginning of the next fiscal period?

- Why are temporary accounts omitted from a post-closing trial balance?

Objectives:

- Define accounting terms related to adjusting and closing entries for a service business organized as a proprietorship

- Identify accounting concepts and practices related to adjusting and closing entries for a service business organized as a proprietorship

- Record adjusting entries for a service business organized as a proprietorship

- Record closing entries for a service business organized as a proprietorship

- Prepare a post-closing trial balance for a service business organized as a proprietorship

https://quizlet.com/111667594/accounting-i-chapter-8-flash-cards/

https://quizlet.com/174335044/accounting-chapter-9-recording-adjusting-and-closing-entries-for-a-service-business-flash-cards/

kahoot review

Journal

- Adjusting entries

- Closing entries

- Post to General Ledger

- Create a Post Closing Trial Balance

Chapter 10

Chapter 10 -Essential Questions:

- What makes the activities of a merchandising business different from those of a service business?

- What are the types of merchandising businesses and how do they differ?

- How is the purchase of merchandise journalized using a purchases journal?

- How does the cash payments journal differ from the general journal?

Objectives:

- Define accounting terms related to purchases and cash payments for a merchandising business.

- Identify accounting concepts and practices related to purchases and cash payments for a merchandising business.

- Journalize purchases of merchandise for cash.

- Journalize purchases of merchandise on account and buying supplies.

- Journalize cash payments and other transactions.

Accounting Cycle- Merchandise Business

9-1 Explanation: Exercises are different

Accounting Concepts Quiz: https://quizlet.com/34453892/century-21-accounting-concepts-flash-cards/ (Business Entity, Going Concern, Historical Cost, and Objective Evidence)

https://quizlet.com/4727151/chapter-10-journalizing-purchases-and-cash-payment-flash-cards/

https://quizlet.com/9099660/chapter-10-journalizing-purchases-and-cash-payments-flash-cards/

Book:

http://www.cdschools.org/cms/lib04/PA09000075/Centricity/Domain/171/Chapter%2010%20Text.pdf

Internet Activity:

http://www.c21accounting.com/student/green/gj_student_internet_frame.html

Chapter 11

Chapter 11 -Essential Questions:

- What is the purpose of collecting and journalizing sales tax?

- Which accounting concept is being applied when revenue is recorded at the time a sale is made, regardless of when payment is made?

- What is the purpose of proving a journal?

- Describe how to prove cash?

Objectives: SWBAT

- Define accounting terms related to sales and cash receipts for merchandising business

- Identify accounting concepts and practices related to sales and cash receipts for a merchandising business

- Journalize sales and cash receipts transactions for a merchandising business

- Prove and rule a journal

Accounting Cycle- Merchandise Business

Book:

http://www.cdschools.org/cms/lib04/PA09000075/Centricity/Domain/171/Chapter%2011%20Text.pdf

Sales Tax Calculator: http://www.calculator.net/sales-tax-calculator.html

https://quizlet.com/4836669/chapter-11-journalizing-sales-and-cash-receipts-flash-cards/

Chapter 12

Chapter 12 -Essential Questions:

- How do you post to a general, accounts payable, and accounts receivable ledgers?

- How do you post to a general ledger from a journal?

- What are the accounting practices related to posting to ledgers?

Objectives: SWBAT

- Define accounting terms related to posting to ledgers

- Identify accounting practices related to posting to ledgers

- Post to a general ledger from a journal

- Post to an accounts payable ledger

- Post to an accounts receivable ledger

- Verify the accuracy of accounting records

Accounting Cycle- Merchandise Business

- https://www.studystack.com/flashcard-832480

- https://quizlet.com/3876443/chapter-11-posting-to-general-and-subsidiary-ledgers-flash-cards/

- https://www.quia.com/cm/65043.html

- https://www.quia.com/jg/516661.html

- https://www.quia.com/jg/1140065list.html

- Kahoot.

Chapter 13

Chapter 13 -Essential Questions:

- How do you prepare payroll, payroll checks, and the records that must be maintained?

- How do you calculate payroll taxes?

- How do you complete a payroll register?

Objectives: SWBAT

- Define accounting terms related to payroll records

- Identify accounting practices related to payroll records

- Complete a payroll time card\calculate payroll taxes

- Calculate payroll taxes

- Complete a payroll register and an employee earnings record

- Prepare payroll checks

Accounting Cycle- Merchandise Business

2017 Hourly Wage Calculator http://us.thesalarycalculator.co.uk/hourly.php

Time Card Calculator – https://www.redcort.com/Free-Timecard-Calculator/

- W4 Guide:

Review Sites:

- Prezi: review of chapter – http://prezi.com/wuypfsvkbfz2/?utm_campaign=share&utm_medium=copy&rc=ex0share

- http://www.cram.com/flashcards/chapter-12-13-preparing-payroll-records-6927899

- https://quizlet.com/192720189/accounting-chapter-13-preparing-payroll-records-flash-cards/

- https://quizlet.com/83617976/accounting-i-chapter-12-preparing-payroll-records-flash-cards/

Chapter 14

Chapter 14 -Essential Questions:

- How do you record employer payroll taxes?

- How do you prepare an employer annual report to employees of taxes withheld?

- Explain how to record payroll in a journal.

Objectives: SWBAT

- Define accounting terms related to payroll accounting, taxes, and reports

- Identify accounting concepts and practices related to payroll accounting, taxes, and reports

- Analyze payroll transactions and record a payroll

- Record employer payroll taxes

- Prepare selected payroll tax reports

- Pay and record withholding and payroll taxes

Accounting Cycle- Merchandise Business

- https://quizlet.com/20331690/chapter-14-accounting-audit-your-understanding-flashcards/

- https://www.quia.com/rr/1002543.html

- https://prezi.com/u9lnwip7dwpe/accounting-chapter-14/

- https://quizlet.com/134884125/chapter-13-payroll-accounting-taxes-and-reports-flash-cards/

Chapter 15

Chapter 15 -Essential Questions:

- In what order should general ledger accounts be listed on a worksheet?

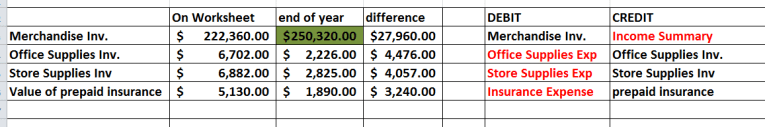

- What accounts are used for the adjustment for merchandising inventory?

- When does a net loss appear on a worksheet?

- What extra step is required when a 10-column worksheet is prepared instead of an 8- column worksheet?

Objectives: SWBAT

- Define accounting terms related to a worksheet for a merchandising business

- Identify accounting concepts and practices related to a worksheet for a merchandising business

- Begin a worksheet for a merchandising business

- Plan adjustments on a worksheet for a merchandising business

- Complete a worksheet for a merchandising business

Accounting Cycle- Merchandise Business

- https://quizlet.com/2044798/acct-ch-15-flash-cards/

- https://www.quia.com/jg/347234list.html

- https://www.quia.com/jg/1140124list.html

- Like Kahoot: https://quizizz.com/admin/quiz/585a847369cac46733fa41f2

- Videos: http://www.accounting-world.com/2012/02/closing-entries-for-merchandising.html

- https://www.youtube.com/watch?v=7m_EVl4nb8g

Chapter 16

Chapter 16 -Essential Questions:

- What is the major difference between the income statement for a merchandising business and a service business?

- How does a company determine acceptable component percentage?

- What information used to prepare an owners’ equity statement is obtained from the partners’ capital and drawing accounts?

Objectives: SWBAT

- Define accounting terms related to financial statements for a merchandising business organized as a partnership

- Identify accounting concepts and practices related to financial statements for a merchandising business organized as a partnership

- Prepare an income statement for a merchandising business organized as a partnership

- Analyze an income statement for a merchandising business organized as a partnership

- Prepare a distribution of net income statement and an owner’s’ equity statement merchandising business organized as a partnership

- Prepare a balance sheet for merchandising business organized as a partnership

Accounting Cycle- Merchandise Business

- https://www.quia.com/jg/516678.html

- https://www.quia.com/jg/1140068list.html

- https://quizlet.com/206188146/accounting-i-chapter-16-financial-statements-flash-cards/