Section 1 Planning and Values

Essential Questions:

- What experiences in your life have shaped your beliefs and ideas on money?

- How do you decide what to spend your money on?

- What factors affect your financial decisions?

Objectives:

Students will be able to

- Identify different ways that they relate to money

- Assess their own personal values that shape how they make financial decisions

**Planning and Values Presentation**

Assignment:

- Create a Video of your spendster expense. Introduce yourself, list the item that you buy often and calculate how much you spend throughout the year for the item. Finally, list what you could do with the money if you did not have the spending habits. Film this video using your phone and then upload the video to the classroom Spendster Assignment Spendster Assignment Rubric

Section 2: Goal Setting

Essential Questions:

- How can your personal goals be achieved through money goals?

- How do you prioritize actions while working to achieve several goals at the same time?

Objectives:

Students will be able to

- Discuss how personal goals can be achieved through money goals.

- Explain how to write an effective financial goal.

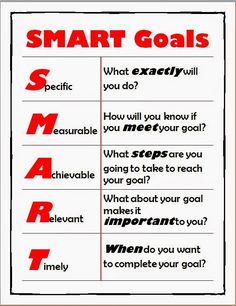

- Discuss how to prioritize actions while working to achieve several goals at the same time.

**Goals Presentation**

SMART Goals Make Over 1.6 – turn in on classroom

Assignment:

In this Google Slide: Create at three financial goals (Short-Term, Medium, and Long-Term) that are specific, measurable, attainable, relevant to your life, and time-bound. Upload to classroom.

Section 3: Decision Making

Essential Questions:

- What influences your spending decisions?

- What strategies help you take control of your spending?

- How does a criterion-based decision-making process work?

Objectives:

Students will be able to

- Discuss what influences your spending decisions.

- Identify tools and strategies you can use to better manage your spending habits.

- Demonstrate how the criterion-based decision-making process works.

**Decision Making Presentation**

Activities:

Assignment:

Apply the DECIDE steps as you decide the best option for a major purchase you are considering sometime in the next six months. (place in classroom) DECIDE Template

Section 4: Budget / Spending Plan

Essential Questions:

- How can a budget/spending plan help you better manage your spending habits?

- What is a budget/spending plan?

Objectives:

Students will be able to

- Discuss how a budget/spending plan can help an individual manage spending habits.

- Describe what a budget/spending plan is.

- Explain how to use a budget/spending plan.

**Budgeting Presentation**

Activities:

- Spending Plan/Log: Complete Tom’s Spending Log

- DATA CRUNCH: What does the average household spend money on?

- Tips and Techniques for How to Manage Your Money Video Introduction

- Budget Exercise Student Introduction Exercises (pick 2)

- Budget Parts Practice

- Create your own budget.

- http://playspent.org/

- Play Money Magic (create a budget) game. (Intro Video)

- 6 Reasons Why You NEED a Budget Article You probably know by now that a budget is a useful way for you to keep track of your money. But what exactly makes it such a powerful tool? Skim through this article to find out. Then, answer the questions:

- Out of the six reasons provided, which is the most important to you? Why?

- Despite these six reasons for keeping a budget, many people do not have a budget. Why do you think this is? (enter on class notes)

- How “Wants” Will Sabotage Your Budget: This article gives you a list of additional questions you can ask yourself when determining whether a purchase you’re about to make is a want or a need. Using these questions as a guideline, make a list of 3 things you need in the next month and 3 things you want.

- Spending Plan Quiz

- What is the Difference Between Gross Income and Net Income? One of the first steps of creating a budget is determining how much income you have. However, using your annual gross salary when creating a budget can be misleading. Watch this video to understand what the difference is between gross and net income. Then, answer the questions. Video Link

-

-

- In your own words, explain the difference between gross income and net income.

-

2. Why do you think it is important that you use net income, not gross income, when creating a budget? (enter on class notes)

-

- 50/20/30 Intro Video: The 50/20/30 Rule for creating a budget:Some first-time budgeters may find creating a budget to be an overwhelming process. Others may under or overestimate how much money they need for certain categories. Review the image to learn about the 50-20-30 rule, a popular rule of thumb in budgeting. Then, skim the article to see how you can easily create a budget and adjust it to help you manage your finances more accurately. 50-20-30 Budget Rule Worksheet

- Do you think you will use the 50-20-30 budgeting rule of thumb when creating your own budget?

- If yes, what about the rule do you like that convinced you to use it?

- If no, what would you change about the rule?

- Do you think you will use the 50-20-30 budgeting rule of thumb when creating your own budget?

-

Assignment: (Classroom)

- Creating a Salary Based Budget

Section 5: Budget Dilemmas

Essential Questions:

- How can you plug spending leaks?

- What can you to do stick to a budget/spending plan?

- How can you prepare yourself for unexpected money events?

Objectives:

Students will be able to

- Identify how to plug spending leaks.

- List strategies to stick to a spending plan

- Discuss ways to be prepared for unexpected money events.

***Budget Dilemmas Presentation***

Activities:

- BUCKET: What are two ways you can realistically bring in more cash? Hint: Think about skills or talents you have that other people might need or want. (classroom notes)

- SPENDING LEAKS: Ideas

-

- Complete the Money Management Self Assessment (Handout)

- Optional: Spending Leaks Worksheet

Extra Credit

-

Assignment: (Classroom)

Vocabulary

Test Review Material:

- Planning Unit Review Notes

- Budget review Carl’s Budget

- SMART Worksheet Handout

- Kahoot

- Test Review-Quizlet